Disclaimer: sources are the Bank of Zambia, LuSE and ZamStats. The information on our analytics is based on sources deemed reliable, but Pangaea Securities Limited accepts no liability for any loss resulting from its’ use or from any omissions. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures. Pangaea Securities Limited, their affiliates, directors, officers and employees may have a long or short position in Zambian securities including any described herein.

Daily Market News

Zambia Looks To UAE And Saudi Arabia To Back Copper Expansion – Bloomberg

Zambia aims to increase copper output to a record above 1 million tons this year, as it deepens ties with oil-rich Gulf nations such as the United Arab Emirates and Saudi Arabia. Production may climb from about 720,000 tons in 2024, according to Jito Kayumba, special assistant for finance and investment to Zambia’s president. International Resources Holding RSC Ltd. of Abu Dhabi has already raised output by 32% at the Mopani mine, after winning a bid to buy a majority stake at the end of 2023, Kayumba said in an interview in Riyadh. Now IRH is is targeting production of 150,000 tons for 2025, he added. IRH didn’t immediately comment. Kayumba, who’s attending the Future Minerals Forum, said Zambia also expects more deals with Saudi Arabia after this week signing a memorandum of understanding with the kingdom to collaborate on mineral resources.

Defaulter Zimbabwe Mulls Debt-For-Nature To Revamp USD21 Billion Arrears – Bloomberg

Zimbabwe is considering using a debt-for-nature swap to restructure some of the USD21 billion it owes to international creditors. The Southern African nation, whose failure to repay its debts has left it locked out of global financial markets for a quarter of a century, is exploring whether a swap is an avenue to pursue, Finance Minister Mthuli Ncube said in response to Bloomberg questions during an X spaces held Thursday on the social media platform. The nation has “made a bit of progress” with creditors, he added. Zimbabwe has already explored several other options in its efforts to tackle its debt, which Ncube has called an “albatross around the economy.” These include trying and failing to list a USD200 million bond, as well as seeking outright debt relief.

IFC Proposes Investment In Africa-Focused VC Fund – Africa Private Equity News

The International Finance Corporation (“IFC”) has disclosed a proposed equity investment of up to USD6 million in the Lofty Alpha Fund, a closed-end pan-African venture capital vehicle targeting seed stage technology-enabled businesses across sectors. The fund, managed by LoftyInc Capital Management, has a target size of USD50 million and will be domiciled in the United States of America. The fund will invest across the African continent.

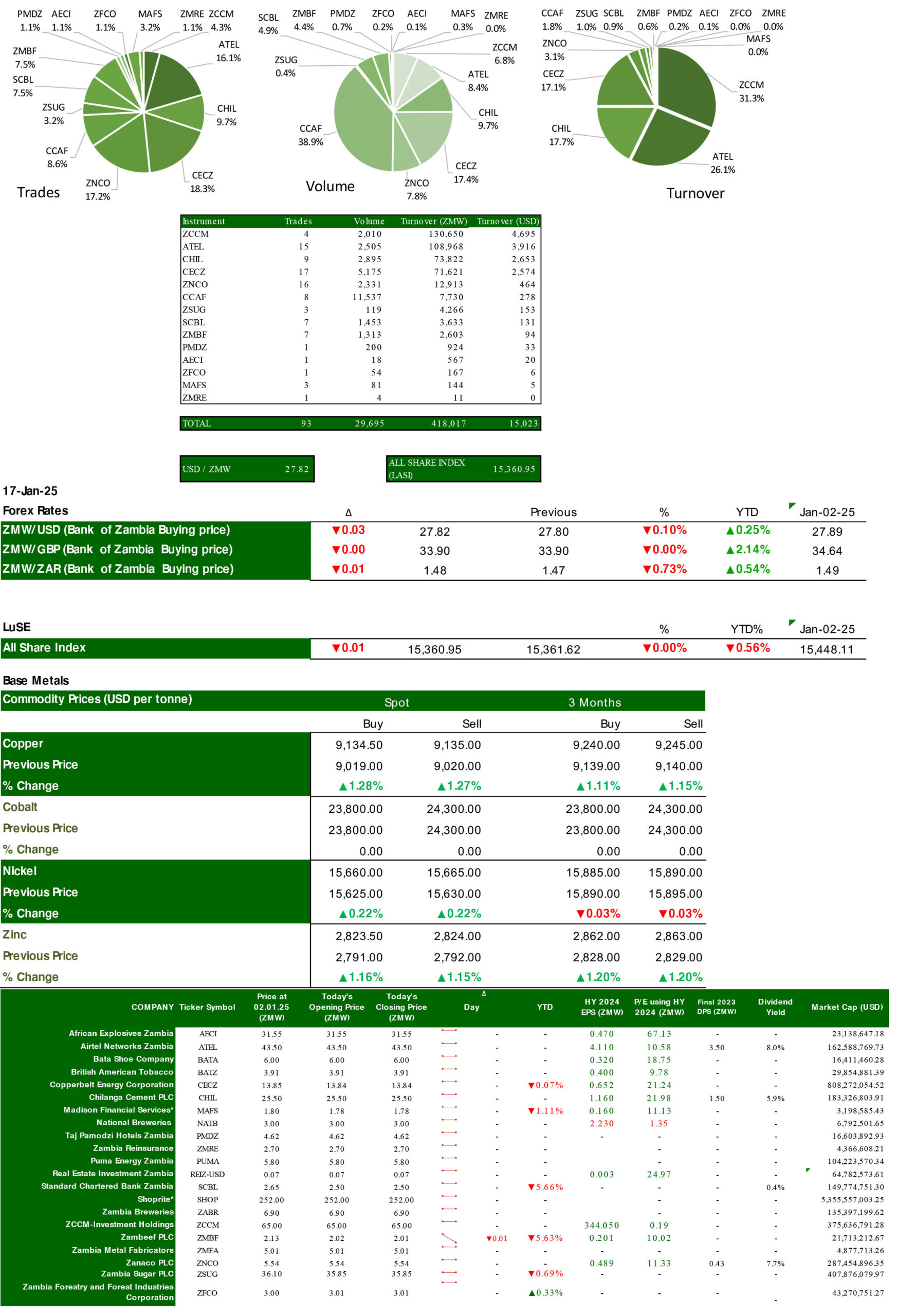

Zambia Bonds Trading Summary

3 government bond trades were processed today with a face value of ZMW1,162,000 generating a turnover of ZMW1,098,690.

Lusaka Securities Exchange Trading Summary

For ZMW denominated securities: In 93 trades recorded today 29,695 shares were transacted resulting in a turnover of ZMW418,017.45. The following price changes were recorded today: -ZMW0.01 in ZMBF. Trading activity was recorded in the following securities AECI, ATEL, BATA, CECZ, CHIL, MAFS, SCBL, ZCCM, ZMRE, ZNCO, ZSUG as well as PMDZ and CCAF on the quoted tier.

For the USD denominated security (REIZ): No trades in REIZ took place today. The LuSE All Share Index (“LASI”) closed at 15,360.95 points 0.00% lower than the previous trading day close. The market closed on a capitalization of ZMW215,596,634,122.50 including Shoprite Holdings and ZMW78,744,744,514.50 excluding Shoprite Holdings.

Leave A Comment