Please find attached in this email the Daily Market News Summary, the London Metal Exchange rates, Foreign Exchange rates, and a summary of the Lusaka Securities Exchange performance.

Disclaimer: sources are the Bank of Zambia, LuSE and ZamStats. The information on our analytics is based on sources deemed reliable, but Pangaea Securities Limited accepts no liability for any loss resulting from its’ use or from any omissions. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures. Pangaea Securities Limited, their affiliates, directors, officers and employees may have a long or short position in Zambian securities including any described herein.

Daily Market News

Bank Of Zambia Takes Over Mybucks Zambia Amid Insolvency Crisis– Zambian Monitor

The Bank of Zambia (“BoZ”) has seized control of MyBucks Zambia Limited (Ecsponent Financial Services) due to insolvency, under Section 64 of the Banking and Financial Services Act. This action protects depositors and creditors. The BoZ will now assess the company’s affairs and take further action. MyBucks, operating in several Southern African countries, entered Zambia in 2019 and was listed on the Johannesburg Stock Exchange.

IMF Says South Africa Needs To Reduce Debt For Faster Growth – Bloomberg

The IMF has urged South Africa to cut its debt burden by 1% of GDP annually for three years to boost economic growth. This will require fiscal adjustment through wage discipline, state-owned enterprise reforms (like Eskom and Transnet), and tighter procurement. South Africa’s debt has ballooned, hindering economic growth and crowding out essential spending. The IMF has emphasized the need for reforms that both boost growth as well as address fiscal challenges. This includes rationalizing state-owned enterprise wages and staffing and controlling public sector wage growth. Finance Minister Godongwana will present the budget amidst pressure for increased spending.

Goldman Sachs Raises China Stock Market Target On AI Boost – Reuters

Goldman Sachs raised its target price for Chinese stocks on Monday, estimating that AI adoption could boost earnings growth and potentially bring in USD200 billion of inflows. Chinese tech stocks have been on a strong rally, clocking their best winning streak in over two years last week, boosted by DeepSeek’s AI breakthrough, which reignited investor interest in China’s technology capabilities. On Monday, Goldman raised its 12-month target price for China’s CSI300 index to 4,700 from 4,600. It also raised its price target for MSCI China to 85 from 75.

Zambia Bonds Trading Summary

18 government bonds were processed today with a face value of ZMW200,745,140 and with a market value of ZMW171,793,800.

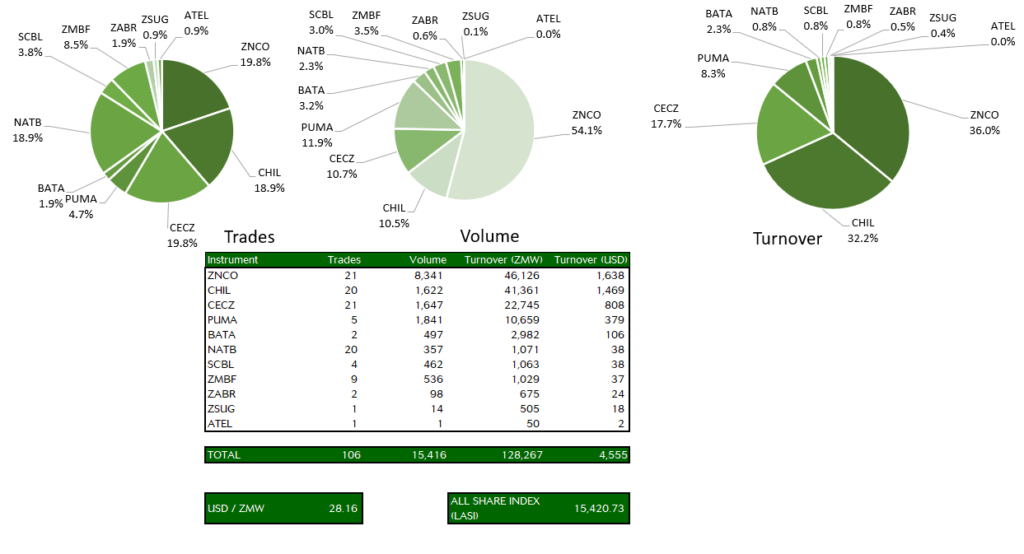

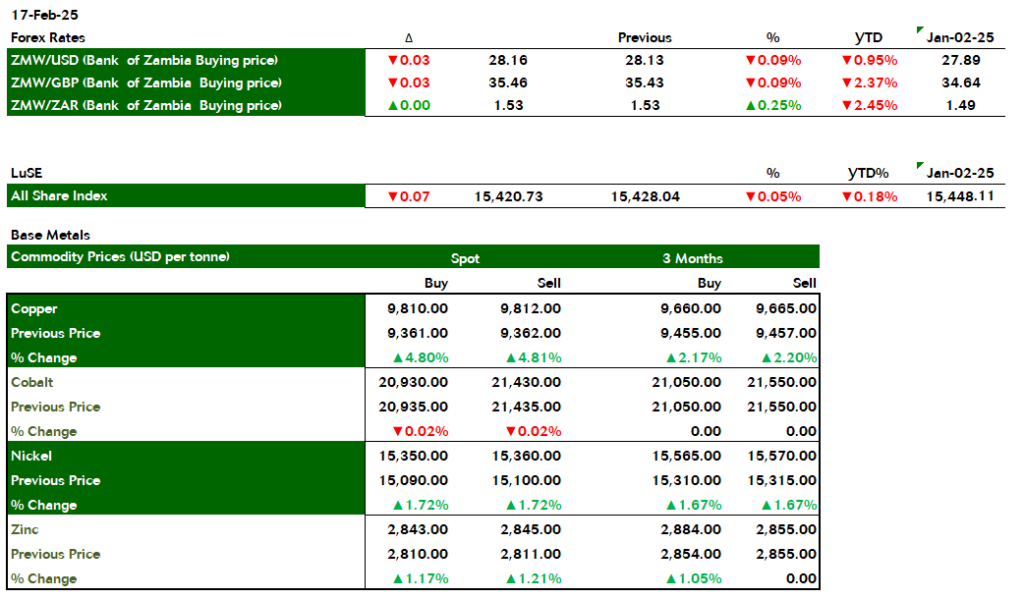

Lusaka Securities Exchange Trading Summary

For ZMW denominated securities: In 106 trades recorded today 15,416 shares were transacted resulting in a turnover of ZMW128,266.53. A price loss of ZMW0.02 was recorded in CECZ today. Trading activity was also recorded in the following securities ATEL, BATA, CHIL, NATB, PUMA, SCBL, ZABR, ZMBF, ZBCO and ZSUG.

For the USD denominated security (REIZ): No trades were recorded in REIZ.

The LuSE All Share Index closed at 15,420.73 points, 0.05% lower than its previous trading day close. The market closed on a capitalization of ZMW215,862,430,211.92 including Shoprite Holdings and ZMW79,010,540,603.92 excluding Shoprite Holdings.

Leave A Comment