Daily Market News

Zambian Government Resolves Not To Seek One-Year Extension Of Current IMF Extended Credit Facility Programme – Zambia Monitor

The Zambian government has announced that it will not pursue a one-year extension of its current International Monetary Fund (“IMF”) Extended Credit Facility (“ECF”) program. Instead, officials would move directly to a full successor arrangement that would run the complete course, reflecting a deliberate shift toward a growth-focused economic agenda. The government had initially sought a 12 month extension and in September won a three month window to negotiate, hoping to secure an additional USD145 million. The IMF confirmed that with Zambia’s withdrawal from the extension, discussions on prolonging the arrangement have ended, though the board will still consider the sixth and final review of the program, which could release around USD190 million.

Acumen’s Hardest-To-Reach Initiative Raises USD250 million – Africa Private Equity News

Impact investor Acumen has announced that its Hardest-to-Reach Initiative (“H2R”) has secured a total of USD250 million in blended capital to expand clean energy access across sub-Saharan Africa. The initiative aims to reach nearly 70 million people across underserved geographies in sub-Saharan Africa, including 50 million first-time energy users in markets where traditional capital has not been able to operate. H2R combines a patient capital, market-building facility, Catalyze, with a debt fund, H2R Amplify. Together, the two vehicles are designed to unlock clean, affordable, distributed energy for households and small businesses across 17 countries, including Malawi, Zambia, and Somalia

Kenya’s Private Sector Ends 2025 On A Strong Note, PMI Shows – CNBC Africa

Kenya’s private sector economy maintained solid growth in December, driven by robust customer demand and increased business activity, the Stanbic Bank Kenya Purchasing Managers’ Index (“PMI”) showed on Tuesday. The headline PMI stood at 53.7 in December, down from 55.0 in November, indicating a continued expansion in business conditions. Readings above 50.0 denote growth, while those below indicates contraction. Kenyan firms reported a marked rise in activity, sales, and purchases, with employment growth hitting its highest rate since November 2019.

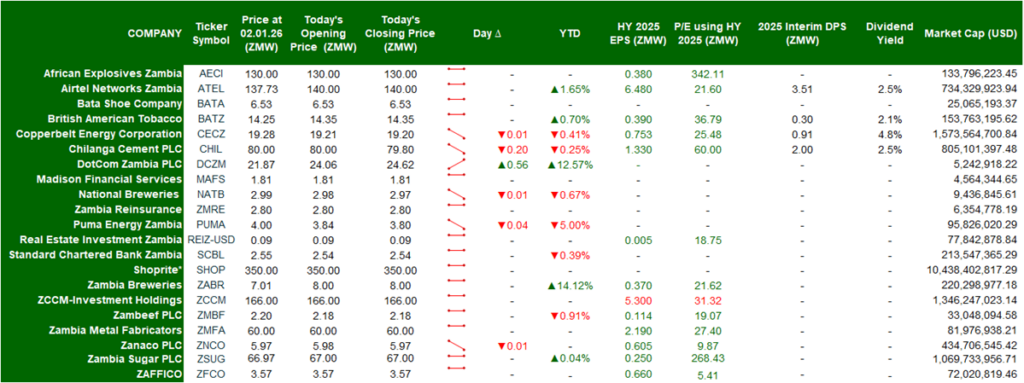

Disclaimer: sources are the Bank of Zambia, LuSE and ZamStats. The information on our analytics is based on sources deemed reliable, but Pangaea Securities Limited accepts no liability for any loss resulting from its’ use or from any omissions. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures. Pangaea Securities Limited, their affiliates, directors, officers and employees may have a long or short position in Zambian securities including any described herein.

Leave A Comment